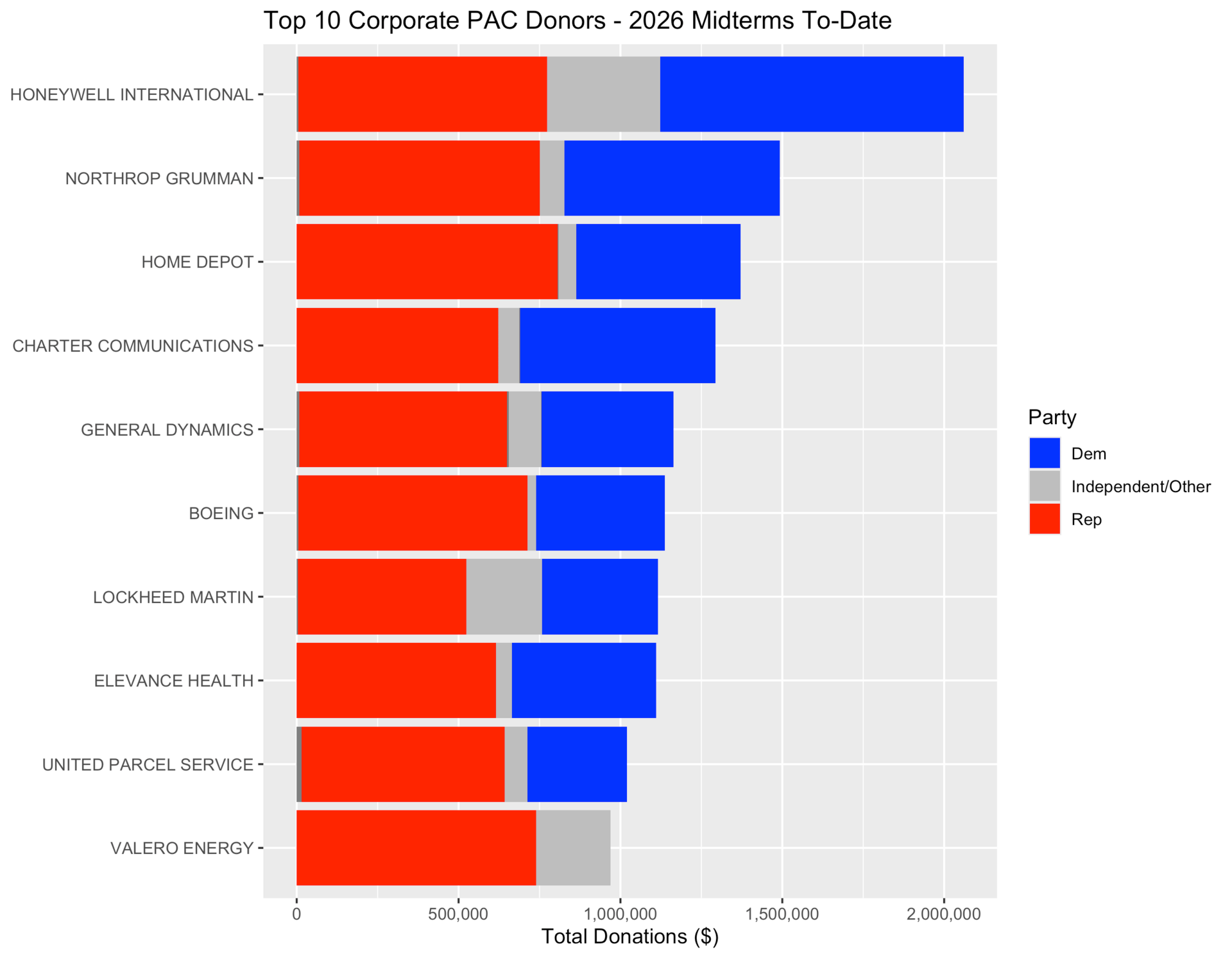

The 2026 Midterm elections are already seeing millions of dollars of corporate PAC donations pour into campaigns for Senate and House seats (along with organizations like the Congressional and Senate leadership funds). With over $66.6 million raised for campaigns and congressional funds, and 407 PACs spending money across political parties, it begs the question: what could be motivating some of the largest PAC spenders this election cycle?

Here’s a closer look at the biggest Corporate PAC donors of this cycle (so far), and what could be driving their spending:

1) Honeywell International2026 Donations (to-date) $2.06m ($938k to Dems, $768k to Reps)Industry: Aerospace / Defense

Top Recipients: Tom Cole (R-OK), Darin LaHood (R-IL), Mark Warner (D-IN), Raja Krishnamoorthi (D-IL), Haley Stevens (D-MI), Katherine Clark (D-MA)

The corporation has been transparent in its political priorities, which include energy efficiency, emission reduction, and national security — priorities that top political recipients have been vocal supporters of. Namely, democrat Haley Stevens has been advocating for a balance between innovation — artificial intelligence, for example — and national security to protect citizens’ private data.

2) Northrop Grumman2026 Donations (to-date) $1.49m ($666k to Dems, $743K to Reps)Industry: Aerospace / Defense

Top Recipients: Cindy Hyde-Smith (R-MS), Julia Letlow (R-LA), Joe Courtney (D-CT)

Northrop Grumman — the fifth-largest U.S. federal contractor — received 87% of its revenue from the federal government in 2024. Recently, the company has faced mass scrutiny over its supply of weapons during the Gaza War, resulting in protests against the government to divest money from the company.

Both Hyde-Smith and Letlow sit on subcommittees for military and national security-related funding, areas that remain likely political priorities for the major U.S. defense contractor.

Northrop Grumman also notably made the largest donation to the top recipient of corporate PAC funds so far this election cycle, the National Republican Senatorial Committee. The committee has received $1.3 million, with Northrop Grumman donating $105,000, more than double what the second-highest corporate PAC donor has given to the committee.

3) Home Depot2026 Donations (to-date) $1.37m ($507.5k to Dems, $805.5K to Reps)Industry: Home Improvement Retail

Top Recipients: Blake Moore (R-UT), Dave McCormick (R-PA), Mark Warner (D-VA)

4) Charter Communications2026 Donations (to-date) $1.29m ($603k to Dems, $622.5K to Reps)Industry: Telecommunications / Media

Top Recipients: Andy Barr (R-KY), John Thune (R-SD), Katherine Clark (D-MA)

5) General Dynamics2026 Donations (to-date) $1.16m ($407.5k to Dems, $641.5K to Reps)Industry: Aerospace / Defense

Top Recipients: Ashley Hinson (R-IA), Joe Courtney (D-CT), Jon Husted (R-OH), Jim Jordan (R-OH), John Carter (R-TX), Pete Ricketts (R-NE)

General Dynamics, another top defense contractor for the U.S., manufactures both military weapons and modern IT technology, including Generative AI technologies to identify insider threats. The company is also a major contractor for the Department of Homeland Security.

6) Boeing2026 Donations (to-date): $1.14m ($397.5k to Dems, $708.5k to Reps)Industry: Aerospace / Defense

Top Recipients: Adam Smith (D-WA), Tom Cole (R-OK), Donald Norcross (D-NJ), Tom Emmer (R-MN), Sam Graves (R-MO)

7) Lockheed Martin2026 Donations (to-date): $1.12m ($357.5k to Dems, $519k to Reps)Industry: Aerospace / Defense

Top Recipients: Tom Cole (R-OK), John B. Larson (D-CT), Mario Diaz-Balart (R-FL), Steve Scalise (R-LA)

Boeing and Lockheed Martin manufactured artillery used in the most recent U.S. military operations, including Operation Absolute Resolve to capture former Venezuelan leader Nicolás Maduro Moros and the Pentagon’s deployment of F-15E fighter jets to the Middle East.

Both companies are two of the top defense contractors, with Lockheed Martin receiving 73% of its revenue from the federal government. In 2024, 26% of its revenue was from sales of the F-35 — a key aircraft in Operation Absolute Resolve.

Adam Smith has served on the House Armed Services Committee for two decades, now as a ranking member, and has been responsible for the allocation of defense projects that include Boeing. Donald Norcross and Sam Graves also serve on the committee.

Tom Cole, who is a top recipient from both Boeing and Lockheed Martin, is a senior member of the House Appropriations Subcommittee on Defense, stating, “Congress has no greater responsibility than to provide our military with the resources needed to confront the challenges to our national security.”

8) Elevance Health2026 Donations (to-date): $1.11m ($445.5k to Dems, $615k to Reps)Industry: Health Insurance

Top Recipients: Randy Fine (R-FL), Andy Barr (R-KY), Angie Craig (D-MN), Susan Collins (R-ME)

While major U.S. Defense and National Security Contractors have dominated the top 10 Corporate PAC donors, Elevance Health — a health insurance company and entity of the Blue Cross Blue Shield Association — has donated $1.1 million to campaigns this cycle, the majority going to Republican candidates and committees.

Randy Fine, the top recipient of Elevance Health donations by $5,000, sits on the Subcommittee on Health, Employment, Labor, and Pensions, which oversees and guides policies related to healthcare coverage.

9) United Parcel Service (UPS)2026 Donations (to-date): $1.02m ($307.5k to Dems, $627.5k to Reps)Industry: Transportation / Logistics

Top Recipients: Andy Barr (R-KY), Dan Sullivan (R-AK), Ashley Hinson (R-IA)

Barr, the top recipient of UPS donations, is a senior member of the House Financial Services Committee, which oversees the economy, banking systems, and securities and exchanges. The committee shapes policy over monetary policy and international finance.

10) Valero Energy2026 Donations (to-date): $970k ($740k to Reps)Industry: Oil / Gas

Top Recipients: John Thune (R-SD), Mike Johnson (R-LA), Steve Scalise (R-LA)

Valero Energy, the 10th highest corporate PAC donor, was the only corporate PAC of the top 10 to donate entirely to Republican campaigns and committees. Valero donated the most money to Senate Majority Leader John Thune. Thune has taken a strong stance on supporting energy sources, including backing bills that would expand the capabilities of the U.S. Energy Industry.