S. 723: Tribal Trust Land Homeownership Act of 2025

This bill, known as the **Tribal Trust Land Homeownership Act of 2025**, aims to streamline the process for approving mortgages and related documents on Indian land. Here are the main points of the bill:

Objective

The bill requires the Bureau of Indian Affairs (BIA) to process and complete all mortgage packages related to residential and business mortgages on Indian land by specific deadlines to improve homeownership and economic development opportunities for Native Americans.

Key Provisions

1. Definitions

The bill clarifies terms related to mortgages on Indian land, such as:

- Land mortgage: A mortgage for home acquisition, construction, improvements, or economic development on trust land.

- Leasehold mortgage: A mortgage that uses leasehold interest as security for a debt.

- Mortgage package: A complete set of documents needed for mortgage approval submitted to a BIA office.

2. Processing Deadlines

The BIA is mandated to adhere to the following timelines:

- Notify lenders upon receipt of mortgage applications.

- Conduct a preliminary review within 10 days to ensure all documents are complete.

- Approve or disapprove leasehold mortgages within 20 days and other mortgage types within 30 days of receiving complete documentation.

3. Certified Title Status Reports

After approving any mortgage, the BIA must complete necessary title status reports within set times:

- A first certified title status report must be processed within 10 days post-approval if not previously completed.

- Subsequent certified title status reports must also be processed efficiently.

4. Communication and Notices

The BIA must provide timely updates if there are delays in the processing of mortgage packages, including informing both the applicants and lenders about the status of their submissions.

5. Access to Information

The act provides relevant Federal agencies and Indian Tribes with read-only access to certain land documents maintained by the BIA to increase transparency.

6. Reporting Requirements

The Director of the BIA is required to submit annual reports to Congress detailing the number and status of mortgage requests and compliance with deadlines.

7. Establishment of Realty Ombudsman

The bill establishes a new position within the BIA, the Realty Ombudsman, to oversee the enforcement of processing deadlines, provide assistance to tribes and lenders, and facilitate communication among various entities involved in mortgage transactions.

Relevant Companies

- IVR - Invesco Mortgage Capital Inc. may be impacted due to potential increases in residential mortgage applications and demand in this sector.

- AGNC - AGNC Investment Corp. may see effects from changes in mortgage approval processes impacting their business models.

This is an AI-generated summary of the bill text. There may be mistakes.

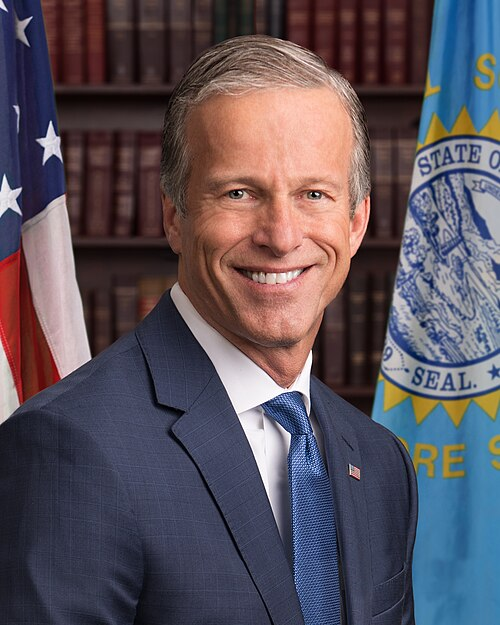

Sponsors

4 bill sponsors

Actions

8 actions

| Date | Action |

|---|---|

| Dec. 11, 2025 | Passed/agreed to in Senate: Passed Senate without amendment by Unanimous Consent. |

| Dec. 11, 2025 | Passed Senate without amendment by Unanimous Consent. (consideration: CR S8689-8691; text: CR S8689-8691) |

| Sep. 29, 2025 | Star Print ordered on 119-60. |

| Sep. 03, 2025 | Committee on Indian Affairs. Reported by Senator Murkowski without amendment. With written report No. 119-60. |

| Sep. 03, 2025 | Placed on Senate Legislative Calendar under General Orders. Calendar No. 148. |

| Mar. 05, 2025 | Committee on Indian Affairs. Ordered to be reported without amendment favorably. |

| Feb. 25, 2025 | Introduced in Senate |

| Feb. 25, 2025 | Read twice and referred to the Committee on Indian Affairs. (text: CR S1350-1352) |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.