S. 3424: Bankruptcy Administration Improvement Act of 2025

This bill, known as the Bankruptcy Administration Improvement Act of 2025, introduces several key changes to the bankruptcy system in the United States. Its main objectives are to adjust the compensation for bankruptcy trustees, to ensure the bankruptcy system is self-funding, and to extend the terms of certain temporary bankruptcy judges. The following outlines the significant provisions of the bill:

Compensation for Bankruptcy Trustees

The bill increases the compensation for chapter 7 bankruptcy trustees. Specifically, it raises the total payment to $120 per case, an increase from the previous $60 that has been unchanged since 1994. This adjustment aims to reflect inflation and the rising costs since the last adjustment.

Bankruptcy Fees and Funding

To support this increase in trustee compensation, the bill also modifies certain bankruptcy fees to generate necessary funding. Existing fees, such as filing fees and quarterly fees in chapter 11 cases, will be adjusted. These adjustments will ensure that the bankruptcy system remains funded without relying on taxpayer money. Key changes include:

- Increasing the fee for chapter 7 cases but keeping the filing fee itself unchanged.

- Ensuring appropriate allocations of fees collected under current law to maintain the integrity and operational effectiveness of the bankruptcy process.

Preserve Bankruptcy Judgeships

The bill seeks to preserve existing bankruptcy judgeships that are essential to handle expected increases in both business and consumer bankruptcy cases. By extending the terms of certain temporary bankruptcy judges from 5 years to 10 years, the bill ensures that these judges are available longer to manage the caseload effectively.

Implementation Timeline

The amendments in this bill will take effect at the beginning of the first calendar quarter after the bill becomes law. However, some provisions, particularly regarding trustee compensation, will apply to bankruptcy cases initiated on or after October 1 following the enactment.

Financial Reporting and Management

The bill emphasizes the importance of regular financial reporting concerning the operation and funding needs of the bankruptcy system. The Attorney General will be responsible for periodic reporting to ensure transparency and adequate funding.

Key Adjustments to Existing Laws

The bill makes specific amendments to sections of the United States Code related to bankruptcy trustees and fees. Notable changes include:

- Adjusting the compensation structure for chapter 7 trustees.

- Updating how collected fees are distributed across federal funds and programs supporting the bankruptcy system.

- Modifying financial coefficients and terms of service for positions that handle bankruptcy cases.

Relevant Companies

- JPM - JPMorgan Chase & Co.: A major player in banking that could see changes in how they manage bankruptcy filings and related legal fees.

- BAC - Bank of America Corp.: Similar to JPMorgan, Bank of America may be affected through adjustments to the bankruptcy process affecting their consumer lending.

- C - Citigroup Inc.: Citigroup may experience impacts in managing its own bankruptcy claims given the changes in trustee compensation and case management.

This is an AI-generated summary of the bill text. There may be mistakes.

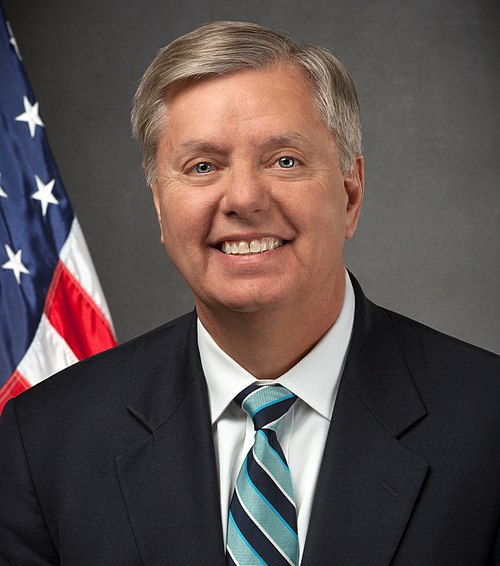

Sponsors

4 bill sponsors

Actions

6 actions

| Date | Action |

|---|---|

| Dec. 11, 2025 | Held at the desk. |

| Dec. 11, 2025 | Message on Senate action sent to the House. |

| Dec. 11, 2025 | Received in the House. |

| Dec. 10, 2025 | Introduced in Senate |

| Dec. 10, 2025 | Introduced in the Senate, read twice, considered, read the third time, and passed without amendment by Unanimous Consent. (consideration: CR S8629-8630; text: CR S8630) |

| Dec. 10, 2025 | Passed/agreed to in Senate: Introduced in the Senate, read twice, considered, read the third time, and passed without amendment by Unanimous Consent. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.